Find A Health Insurance Plan that Fits Your Needs!

State Licensed Insurance Agents are available to assist you with locating a plan. To explore your options, complete the form at the right.

888-745-2320 (TTY: 711)

Questions? Licensed Agents Available!

Monday-Friday: 8:30 AM-5 PM MST

Medicare Plan Options

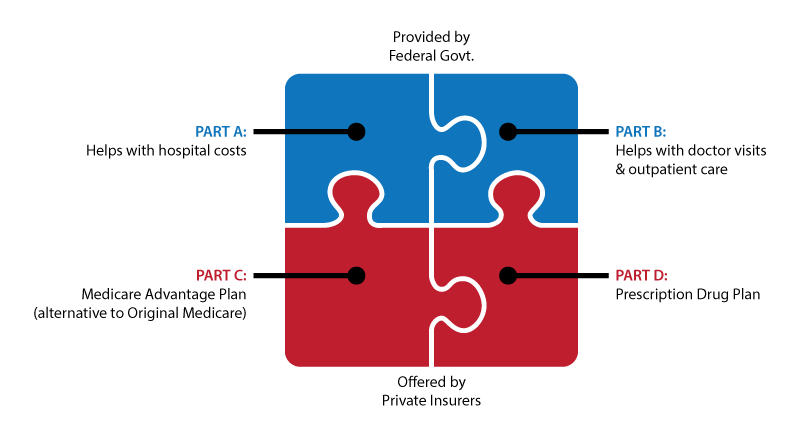

Medicare Basics

Medicare is run by the Centers for Medicare & Medicaid Services (CMS) which is part of the U.S. Department of Health and Human Services (HHS).

Understanding Original Medicare

Part A – Hospital Insurance

| Helps Cover: | Premium |

|

|

Part B – Doctor Visits

| Helps Cover: | Premium |

|

|

Understanding Additional Medicare Plan Options

There are multiple Medicare insurance plan options available, including the following.

Prescription Drugs (Part D)

Original Medicare (Parts A and B) does NOT cover prescription drugs. Therefore, you should enroll in a Prescription Drug Plan if you do not have other coverage, such as drug coverage from a current or former employer or union, TRICARE, Indian Health Service, or the Department of Veterans Affairs.

Prescription Drug Plans:

- Have specific lists of covered drugs

- Are sold by private insurance companies

- Depending on plan, can have:

- Monthly premiums

- Co-insurance

- Tiered co-pays

- Deductibles

- Can be obtained:

- As a stand-alone plan

- As part of a Medicare Advantage plan that includes Part D

Medicare Supplement Insurance (Medigap)

Medicare Supplement Insurance plans help members pay for costs and services not covered by Original Medicare (Parts A and B). Plan types are standardized and identified by letters of the alphabet.

Medicare Supplement Plans:

- Are sold by private insurance companies

- Have monthly premiums that vary by resident state & plan

- Can require underwriting/approval (depending on member situation)

- In most cases, allow members to see any provider who accepts Medicare

- Are often paired with Original Medicare (Parts A and B) and a Prescription Drug Plan

Medicare Advantage (Part C)

Commonly referred to as Part C, Medicare Advantage plans often include extra benefits not found in other coverage options. The most significant difference about these plans is they often have a network of doctors and hospitals for members to choose from; and they provide an all-in-one type of service where members have the convenience of using one card for hospital stays, doctor(s) visits and prescription drug costs.

Medicare Advantage Plans:

- Cover Parts A & B benefits

- Are sold by private insurance companies

- Most often cover prescription drugs

- Monthly premiums vary by state & plan

- Have annual out-of-pocket maximums

- May require you to see a specific network of doctors and facilities

- Are typically guaranteed issue

- Are NOT paired with Medicare Supplement Insurance or (typically) Prescription Drug Plans

For plan information that is specific to meet your needs, contact one of our agents today!